Topic: Tax Fairness

CFT-sponsored wealth tax introduced in California Assembly

Part of coordinated effort with seven other states

In a concerted effort with seven other states, yesterday CFT President Jeff Freitas and Assemblymember Alex Lee (D-San José) reintroduced a tax on extreme wealth in California as AB 259 and an accompanying proposed constitutional amendment, ACA 3.

CFT continues push to tax extreme wealth in California

Assemblymember Alex Lee re-introduces legislation to tax billionaires

This week Assemblymember Alex Lee (D-San Jose) re-introduced his bill, now titled AB 2289, that seeks to impose a tax on the extreme wealth of the richest Californians. The bill would impact approximately 17,000 multi-millionaires and billionaires in California, which is 0.07% of the total taxpayers in our state.

CFT is a proud sponsor of this bill — that would raise more than $22 billion in revenue annually — and will be working closely with Assemblymember Lee as it makes its way through the state Legislature.

CFT wins top awards in national labor media competition

Federation lands 11 awards for communications in 2020

In a friendly competition with state and regional labor groups around the nation, the CFT won 11 awards from the International Labor Communications Association.

The awards show that content is still king. The CFT website won First Place in “best electronic content” for the third year in a row. Seven member-based stories won awards, with four claiming First Place honors.

CFT sponsors California tax on extreme wealth

Why tax extreme wealth?

Since the beginning of the pandemic last March, while our families and our communities have suffered gut-wrenching pain and loss, billionaires in our state alone have increased their wealth by over half a trillion dollars.

And their numbers and their extreme wealth just keep on growing. In March 2020, just as COVID began, there were 154 billionaires in California – with a total wealth of $688.3 billion. In January 2021, there were 169 billionaires in California – with a total wealth of more than $1.2 trillion.

Why your vote for Prop 15 is essential!

FAQ: What Prop 15 will do

Proposition 15 is a fair and balanced reform that will reclaim $12 billion to invest in schools and vital services for our local communities.

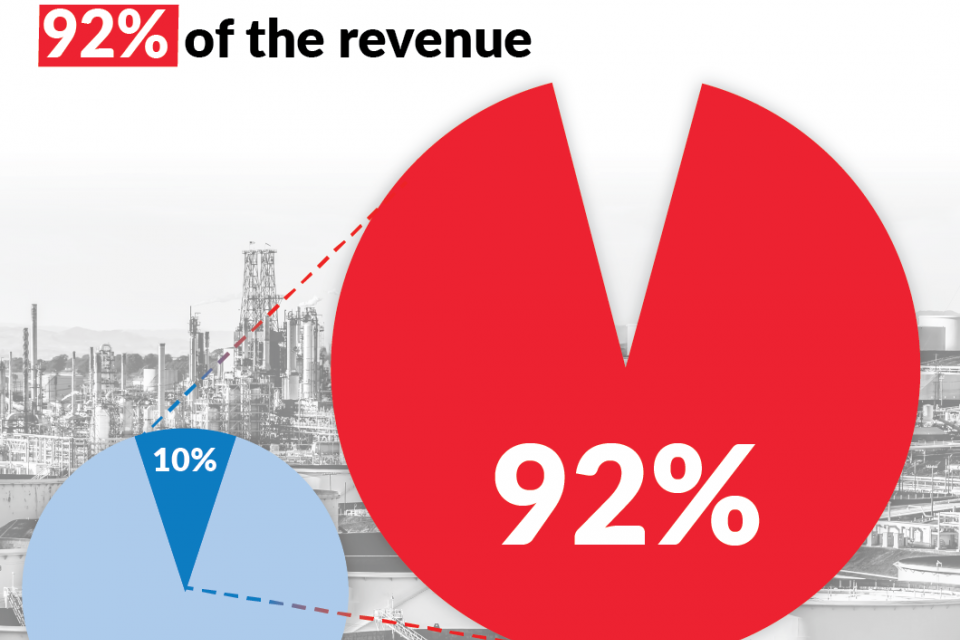

When Prop 15 passes, it will close a loophole that large corporations have used for decades to avoid paying their fair share of property taxes. The richest 10% of corporate properties will provide 92% of the new revenue.

CFT says “Tax Billionaires”

We can’t cut our way to the economic recovery our students deserve!

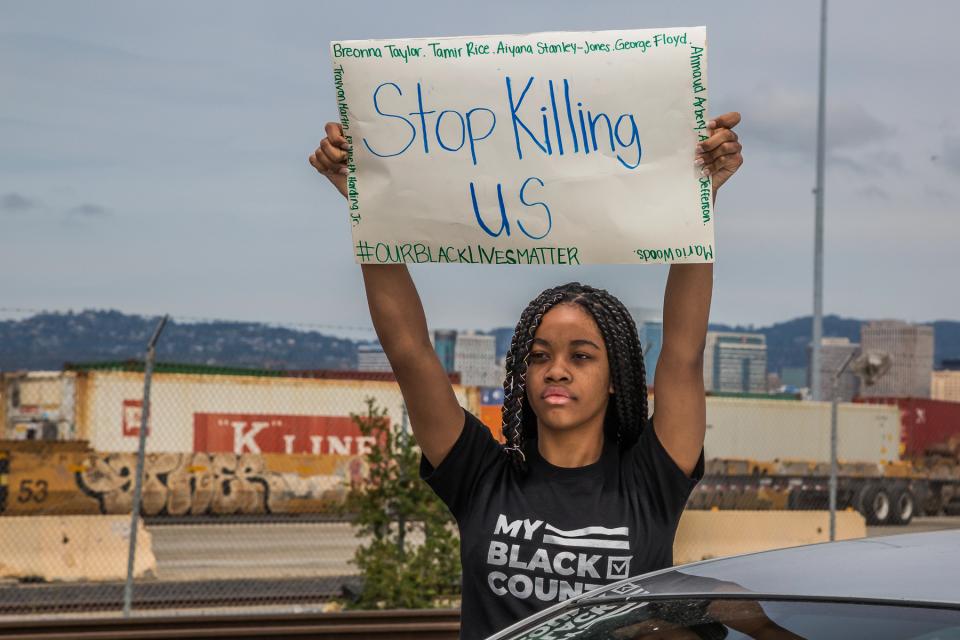

As we navigate the global COVID-19 pandemic, Californians are experiencing crises that reach far beyond the immediate public and personal health emergencies. The poorest Californians, disproportionately people of color in the service, hospitality, and healthcare sectors, have either lost their jobs, resulting in a spike to unemployment unlike anything we have seen in our lifetimes, or are risking their health performing essential frontline services.

How to avoid catastrophic cuts to education and vital social services

OPINION: Tax the super rich

By Jim Miller, AFT Guild, Local 1931

The COVID-19 crisis and subsequent economic collapse along with the national uprising against police brutality and systemic racism have cast a glaring light on the nature of American inequality on the healthcare, criminal justice, and economic fronts. It has never been clearer that as most Americans struggle, the elite thrive.

Members collect 20,000 signatures in support of Schools & Communities First

Hitting statewide goal helped land measure on November 3 ballot

Update: On June 4, Schools and Communities First officially qualified for the November 3 General Election ballot.

Last fall, when CFT began circulating petitions to qualify the Schools and Communities First initiative, seems like a world away. Yet on April 1, the early days of the coronavirus outbreak, the coalition submitted 1.7 million signatures, nearly twice the number needed to put the measure on the November ballot and the most ever gathered in California history.

Our bold step forward to fully fund public education

Schools and Communities First initiative

By Jeffery M. Freitas, CFT President

When CFT received the first batch of petitions to put Schools and Communities First initiative on the ballot in late October, I immediately ripped a box open and took out a form. I eagerly signed the fresh new document to add my name in support of this historic initiative.

Improved corporate tax reform initiative refiled with state

CFT working with coalition to put funding measure on the 2020 ballot

This week, the Schools & Communities First campaign refiled the the split roll ballot initiative with significant improvements. The refiling is a result of organizing during 2018 that allowed the campaign to hear feedback from stakeholders across the state on the ballot measure, and to consult with California’s leading policy and legal experts. CFT is a key member of the campaign coalition.

We can’t afford to go back – Proposition 55 sails to victory

School and college funding secured

In a crowded field of 17 propositions on the statewide ballot November 8, voters clearly saw the value of publicly funded education and passed CFT’s top priority, Proposition 55, with an impressive 24-point margin.

“Make it Fair” creates real change for California

By Josh Pechthalt, CFT President

California’s largest, oldest corporations have not been paying their fair share for more than 35 years. As a result, the state has lost billions of dollars in uncollected property tax revenues — a major factor pushing our public schools to the national bottom in per pupil spending and class size average. The state’s most at-risk families and individuals have also seen essential services repeatedly cut for more than a generation.

Prop. 30 delivers salary relief in recent contracts

After years of stagnant wages, classified employees are finally seeing long-overdue salary relief in recent months.

The raises largely result from the CFT campaign two years ago to pass Proposition 30. This year, the governor’s budget included $5.6 billion in additional funding for K-14 education. Prop. 30 will generate an average of about $6 billion per year for seven years.

Pechthalt honored by UCLA Labor Center

CFT President Joshua Pechthalt was honored Thursday, May 23, 2013, by the UCLA Center for Labor Research and Education, at the Center’s annual banquet, for his work to help pass Proposition 30 in November 2012.

Classified rise to the challenge of passing Prop. 30

Threat of more furlough days spurs community outreach and response

Classified employees had a lot to lose if voters rejected Prop. 30 on November 6. Staff swung into action across California, racking up victories in state and local campaigns that will go a long way toward saving public education.

Gilroy paraprofessionals in AFT Local 1921, for example, resisted pressure to take 10 furlough days until the need was clear, even though district teachers represented by CTA and classified employees represented by CSEA had agreed beforehand to give up the days.

CFT members lead in passing Prop 30, defeating Prop. 32

Working with coalition partners, the union helps reach millions of Californians

Voters in California sent a powerful message on Election Day, passing Proposition 30 which raised income taxes on top earners to support public education — the first major tax increase since passage of the revenue-cutting Proposition 13 almost 35 years ago.

Nearly nine in ten CFT members, 87 percent, voted for Prop. 30, the merger of CFT’s Millionaires Tax and Gov. Brown’s original initiative, according to a post-election poll commissioned by the California Labor Federation.

The Fight for California’s Future

Our campaign for better education funding and fair taxation

With the passage of Proposition 30 in the November 2012 election, California is finally looking at improved prospects. Prop 30 begins the process of reversing the massive redistribution of wealth upwards that has taken place over the past thirty years. By imposing a 1–3% increase on the wealthiest Californians’ income taxes, and a modest sales tax increase of one-quarter of 1%, the state budget will gain some relief and programs in education and social services will not face further savage cuts.

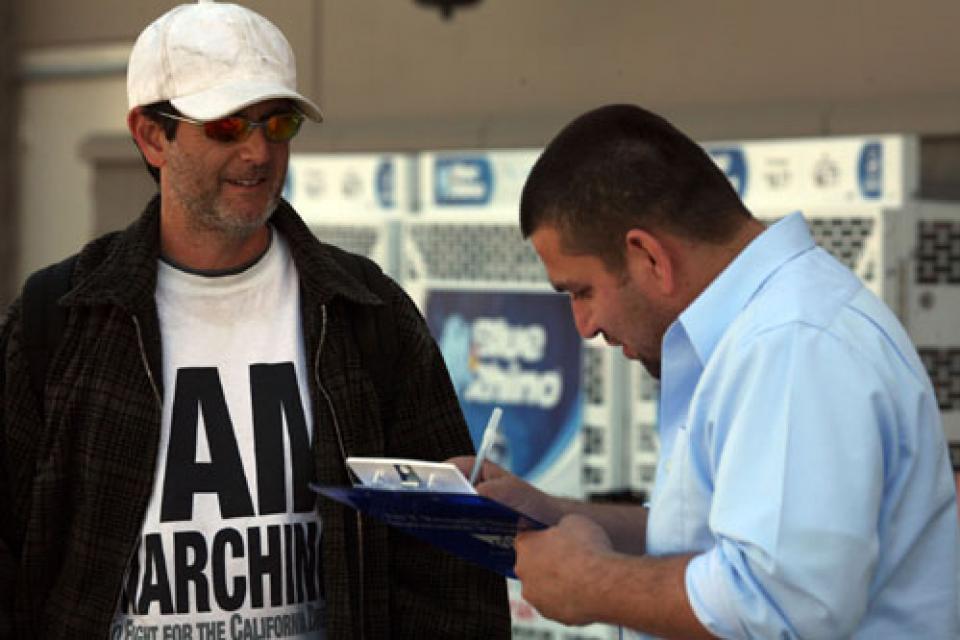

Week 5: March for California’s Future

Marchers say the two-thirds rule cuts teachers and builds prisons

MANTECA, CA (4/11/10) — Beginning the final stretch before their arrival in Sacramento, the hardy band of walkers in the March for California’s Future passed into the California delta at Manteca and Stockton.

Week 4: March for California’s Future

Defending a life's work in education

DELHI, CA (4/3/10) — Evenings in the San Joaquin Valley have grown warmer as the marchers for California’s future head for Sacramento. At the journey’s start in Bakersfield and Shafter, even the days were cold. But as night settles into a campground beside the Merced River just north of Livingston, you can feel spring is in the air.

Week 3: March for California’s Future

A substitute marches for all teachers

REEDLEY, CA (3/20/10) – It’s almost impossible for any teacher to take 48 days out of the school year to march to Sacramento, no matter how high the stakes. So it should be no surprise that the teacher walking to Sacramento representing the thousands of members of United Teachers Los Angeles is a substitute teacher, David Lyell.