Proposition 15 is a fair and balanced reform that will reclaim $12 billion to invest in schools and vital services for our local communities.

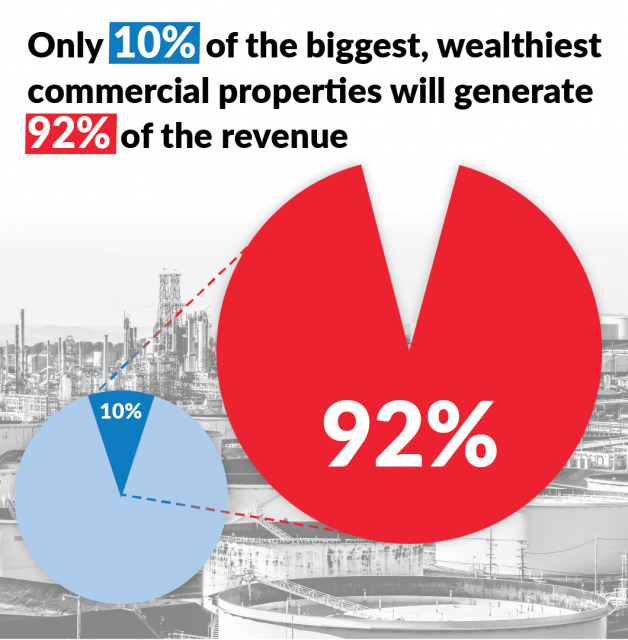

When Prop 15 passes, it will close a loophole that large corporations have used for decades to avoid paying their fair share of property taxes. The richest 10% of corporate properties will provide 92% of the new revenue.

THE BASICS

How does it work?

Prop 15 will require that commercial property valued at more than $3 million is reassessed at fair market value every three years.

- This closes a loophole that large corporations have used for decades to avoid paying their fair share of property taxes.

- The richest 10% of corporate properties will provide 92% of the revenue.

- Prop 15 specifically exempts all residential properties and agricultural land, maintaining full Prop 13 protections for homeowners, renters, and agriculture.

Why is Prop 15 important?

Corporations profit from a property tax loophole to avoid paying their fair share — while small businesses and working families bear more and more of the burden of funding public education and local services. Prop 15 closes this loophole and creates a stable, fair and balanced source of revenue for schools and local communities.

Who is opposing Prop 15?

Big corporate property owners that have been using loopholes to avoid paying their fair share of property taxes for decades, such as the Disney Corporation and Chevron, are trying to stop Prop 15 from passing. A judge recently had to take the extraordinary step of stopping their corporate property coalition from trying to deceive Californians in the official voter guide about Prop 15.

Who is supporting Prop 15?

More than 1,700,000 Californians signed petitions to put Prop 15 on the ballot. The Democratic Party and more than 1,000 community organizations, small business owners, faith leaders, environmental groups, and local elected officials are working with teachers, nurses, firefighters to pass Prop 15.

REVENUE FOR SCHOOLS

How will the money be collected and distributed?

The money will be collected the same, by individual counties: 40% will go to a dedicated education fund, and 60% will be used for local services. Distribution then follows current law.

How do we know that the money will be spent on schools and local services?

Prop 15 ensures strict accountability and transparency, requiring that the public know exactly what the revenue generated by Prop. 15 is spent on.

Will giving more resources to schools actually make a difference in outcomes?

Absolutely. Funding directly impacts outcomes. It takes money to reduce class sizes, equip science labs and music programs, provide librarians, counselors and school nurses, and fund field trips.

Will all districts benefit?

Yes. Prop 15 will provide extra funding for every single school and community college district throughout the state, especially those most in need.

What kind of local community services can be funded?

Important public services that people count on. This could include emergency response to a health crisis, ensuring clean drinking water, fire protection, county hospitals, senior services, efforts to reduce homelessness, and improving parks, libraries, and after-school programs.

Will the funding be used for pensions and salaries?

It could be — if that’s what the local community needs. This might be to recruit or retain teachers, county health workers, and other workers who provide services that neighborhoods count on.

Why aren’t the lottery, Prop 30, and local measures enough?

The lottery provides very little funding for schools. Proposition 30 helped, but mostly halted the huge losses from the recession. Local measures (such as parcel taxes) only exist in a few communities and do not provide funding statewide for schools. Especially given the historic budget shortfalls due to the COVID-19 health crisis, we need stable funding now more than ever.

EFFECT ON RESIDENTS

Does Prop 15 affect homeowners or renters?

NO. It will not affect homeowners or renters. Prop 15 completely exempts ALL residential property and maintains full Prop 13 protections.

Will Prop 15 increase prices for consumers?

No. Businesses price things based on the market (what consumers are willing to pay) — not property taxes.

Will Prop 15 lead to job loss?

No. Prop 15 will help improve local economies and support small businesses — where most jobs are created. Additionally, home-based businesses are classified as residential property and are exempt from reassessment.

How will Prop 15 assess mixed-used property?

Mixed-use property will be exempt if it is predominantly (more than 75%) residential. Otherwise, assessment will be based on the proportion of commercial/residential square feet of the whole property.

EFFECT ON BUSINESS

How will Prop 15 impact farms and agricultural lands?

All agricultural land is exempt from reassessment and will remain fully protected by Prop 13.

How will Prop 15 impact small business?

- Only commercial property owners whose property is worth more than $3 million will be reassessed.

- The vast majority of small businesses are below this threshold.

- The richest 10% of corporate properties will provide 92% of the revenue.

Prop 15 also provides substantial tax breaks for all businesses ranging from a $500,000 exemption to a complete exemption of the business personal property tax.

Will Prop 15 cause small business rents to go up?

No. Rents are determined by the market, not the property taxes a landlord pays.

Will this hurt large employers?

No. Most large employers are already paying property taxes at fair market value. The current system puts them at a competitive disadvantage. It’s the richest 10% of commercial properties not currently paying their fair share that will generate 92% of the revenue for Prop 15.

Will businesses move to other states to avoid paying their fair share?

No. Even after we pass Prop 15, California will still have one of the lowest commercial property tax rates in the country. The richest 10% of corporate properties will provide 92% of the revenue.

What will the percentage tax increase be on reassessed properties?

Prop 15 doesn’t change the current percentage. Prop 15 simply calls for commercial properties valued at more than $3 million to be reassessed based on their on fair market value every three years. The 1% tax rate on the value, which determines the dollar amount in property tax, remains the same.

Won’t this be hard to implement?

Nearly every other state in the country regularly assesses commercial property based on fair market value, meaning Prop 15 will finally bring California into the 21st Century.