Topic: Education Funding

CFT analyzes governor’s proposed budget for 2022-23

Research Brief

Governor Newsom introduced a $286.4 billion budget proposal for 2022-23 on January 10. The proposed budget is 9% larger than last year’s record high budget, largely because of tax receipts that were even higher than expected. The governor’s office is anticipating a $21 billion discretionary surplus for 2022-23 and this includes billions more for education.

CFT continues push to tax extreme wealth in California

Assemblymember Alex Lee re-introduces legislation to tax billionaires

This week Assemblymember Alex Lee (D-San Jose) re-introduced his bill, now titled AB 2289, that seeks to impose a tax on the extreme wealth of the richest Californians. The bill would impact approximately 17,000 multi-millionaires and billionaires in California, which is 0.07% of the total taxpayers in our state.

CFT is a proud sponsor of this bill — that would raise more than $22 billion in revenue annually — and will be working closely with Assemblymember Lee as it makes its way through the state Legislature.

Education sees another increase in governor’s state budget proposal

Legislative Update

Governor Newsom proposed significant increases for education and a 5.33% Cost-of-Living Adjustment (COLA) in his state budget for 2022-23 released January 8. In his proposal, the governor addressed five concurrent state crises — COVID-19, climate change, inequality, homelessness, and public safety — several of which are reflected in the education budget. This budget is a preliminary proposal subject to negotiations with the Legislature and will be revised in May, with its final passage in June.

LAO predicts $31 billion budget surplus for 2022-23

Research Brief

Each November, the Legislative Analyst’s Office (the non-partisan advisor for the state Legislature) prepares a fiscal outlook in anticipation of the state budget process that kicks off in January with the governor’s budget proposal.

Overall, revenues are growing at historic rates and the LAO estimates the state will have a $31 billion surplus to allocate in 2022‑23. The Proposition 98 guarantee for schools and community colleges is estimated to be $11.6 billion (12.4% above the 2021-22 enacted budget). LAO estimates $9.5 billion will be available for new commitments and $10.2 billion will be available for one-time spending.

What does gratitude look like? Find out from three members deep in student debt

How AFT’s legal victory with the Public Service Loan Forgiveness program will change lives

In 2018, Jessica Saint-Paul, who has a doctorate in medical science and teaches public health and health occupation courses at Southwest and Trade Tech colleges, attended a benefits conference put on by her local, the Los Angeles College Faculty Guild. They covered Public Service Loan Forgiveness, a federal program that promised if you worked in public service for 10 years and made 120 payments, the remainder of your loan would be forgiven.

What’s in the largest ever state education budget?

Legislative Update — historic investment coming in 2021-22

On July 9, Governor Newsom signed a historic education budget with an unprecedented investment in our students and schools.

The California Legislature voted on and passed identical budget bills (AB/SB 129) on June 28, after reaching agreement with the governor about most budget issues. The full budget is $263 billion, thanks to an extraordinary surplus and the latest round of federal stimulus funding from the American Rescue Plan. A few outstanding details will be finalized in trailer bills.

CFT sponsors California tax on extreme wealth

Why tax extreme wealth?

Since the beginning of the pandemic last March, while our families and our communities have suffered gut-wrenching pain and loss, billionaires in our state alone have increased their wealth by over half a trillion dollars.

And their numbers and their extreme wealth just keep on growing. In March 2020, just as COVID began, there were 154 billionaires in California – with a total wealth of $688.3 billion. In January 2021, there were 169 billionaires in California – with a total wealth of more than $1.2 trillion.

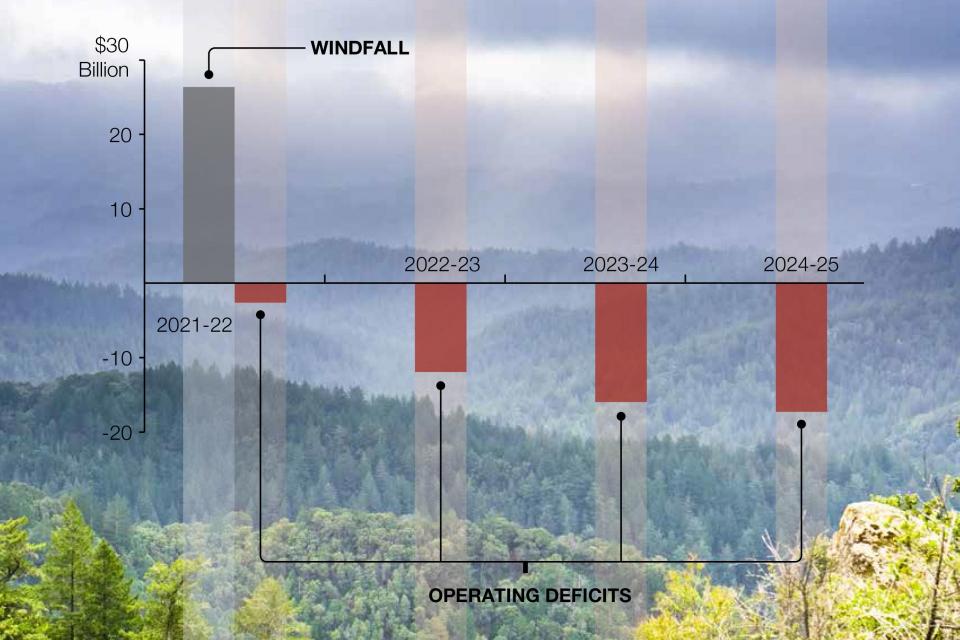

Legislative Analyst forecasts state revenue windfall for 2021-22

Legislative Update

Each November, the Legislative Analyst’s Office (LAO) is tasked with providing the state Legislature with forecasting of the state’s revenue and budget constraints. Those numbers have just been released to provide a starting point for what to expect in budget negotiations for the California 2021-22 state budget.

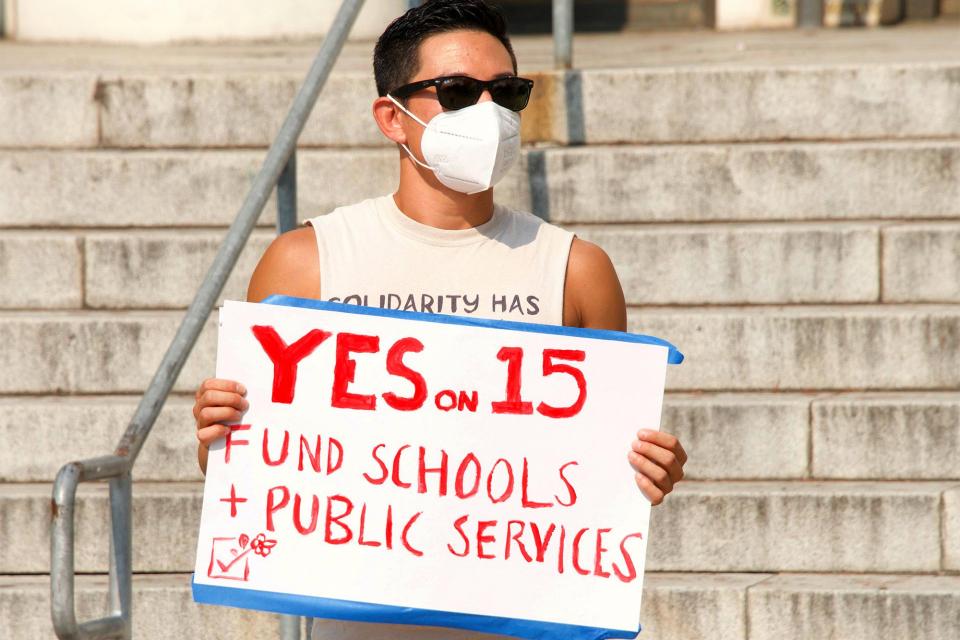

Prop 15 defeated, but our coalition remains strong

CFT members worked so hard to put Proposition 15, also known as Schools & Communities First, on the November ballot and over the finish line right through the close of polling places on Election Day.

But after election day, Prop 15 was trailing by about 400,000 votes with approximately 4 million votes yet to be counted. CFT and campaign allies were optimistic and patient, holding out hope that the measure would amass the votes needed to pass.

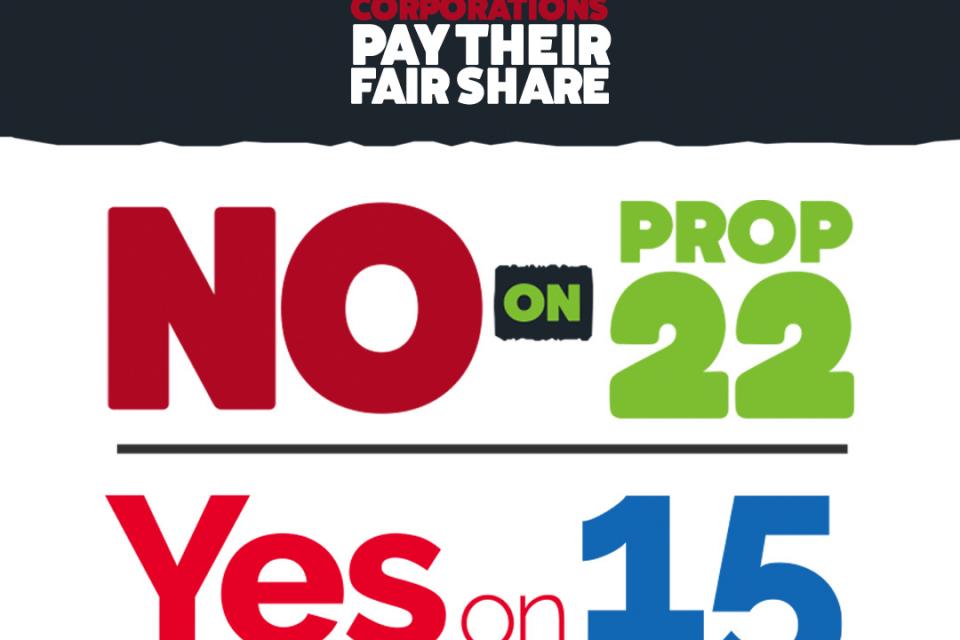

Top 5 reasons to vote NO on Prop 22

Make corporations pay their fair share!

Although there are many important races, Voting NO on Prop 22 is one of the most important decisions you can make on the ballot this year. Here’s why:

- Uber, Lyft and other giant gig corporations have spent $200 million on Prop 22 in an effort to exempt themselves from all labor laws that protect workers. We’re talking about basic protections like a minimum wage, sick leave, workers’ comp and unemployment insurance. These multi-billion dollar corporations are trying to strip workers of virtually every right we’ve fought decades to enact.

Prop 15: It’s not just about closing corporate tax loopholes

It’s about protecting adjunct faculty too!

California is at an educational crossroads made dire by the coronavirus pandemic, and Proposition 15 is an important step in getting California back on the right track.

COVID-19 has not only ravaged the health and lives of countless Californians — it has also ravaged state revenues, with Governor Newsom himself acknowledging overall state revenue declines being in the “tens of billions.”

California governor and major media endorse Prop 15

Corporate tax reform garners deserved support

As we inch closer to the General Election, Proposition 15, also known as School and Communities First, is gaining momentum amongst voters, in part boosted by a wave of critical endorsements.

Yes on 15! Fix commercial tax system to help fund schools and colleges

Prop 15 will improve funding for public education

Over the past 40 years, disinvestment in public education has caused California to fall from one of the top states in per pupil spending to one that ranks near the bottom.

The California Schools & Local Communities Funding Act would raise up to an estimated $12 billion every year for schools and local communities by ending the unfair system that allows a fraction of the wealthiest commercial and industrial property owners to avoid paying their fair share in taxes.

Fixing commercial tax system will help communities prepare for wildfires

Prop 15 will fund local fire protection districts

As a result of our rapidly changing climate, California has experienced the deadliest, largest, and most destructive wildfires in its history.

In the past five years, we’ve had nine of the 20 most destructive fires the state has ever had, including the Camp Fire in Butte in 2018, the Tubbs Fire in Napa and Sonoma in 2017, the Carr Fire in Shasta & Trinity in 2018, and the Thomas Fire in Santa Barbara and Ventura in 2017.

Governor Newsom endorses Prop 15!

Joe Biden endorsed Schools & Communities First last fall

On September 11, Governor Newsom endorsed Prop 15, the CFT-supported ballot measure that will reclaim $12 billion annually for California schools and communities by closing corporate property tax loopholes.

“The governor’s support of Prop 15 is critical to ensure that this essential initiative passes and our schools have the resources they need so that our students receive the education they deserve,” said CFT President Jeff Freitas.

Why your vote for Prop 15 is essential!

FAQ: What Prop 15 will do

Proposition 15 is a fair and balanced reform that will reclaim $12 billion to invest in schools and vital services for our local communities.

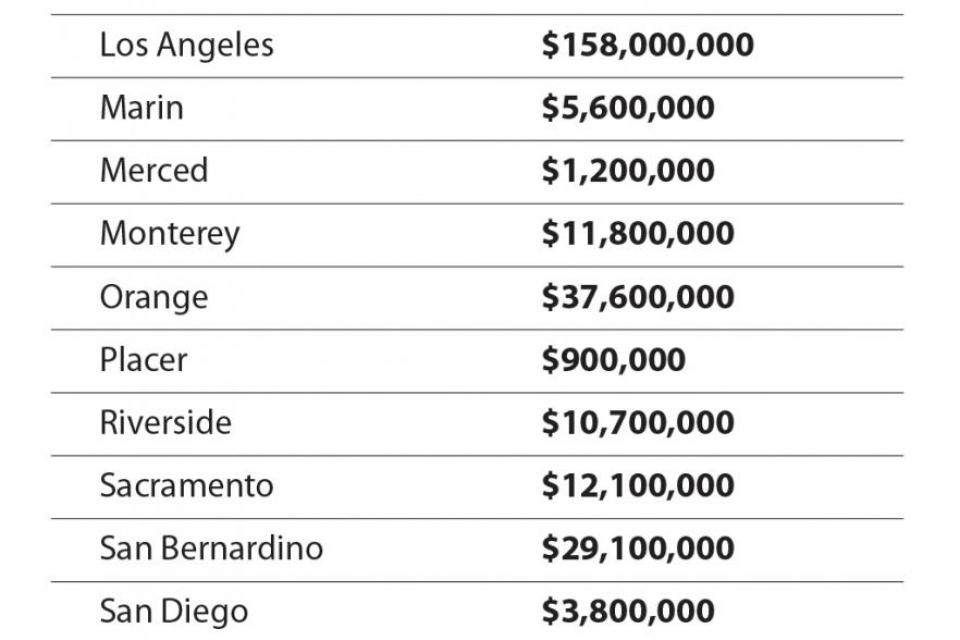

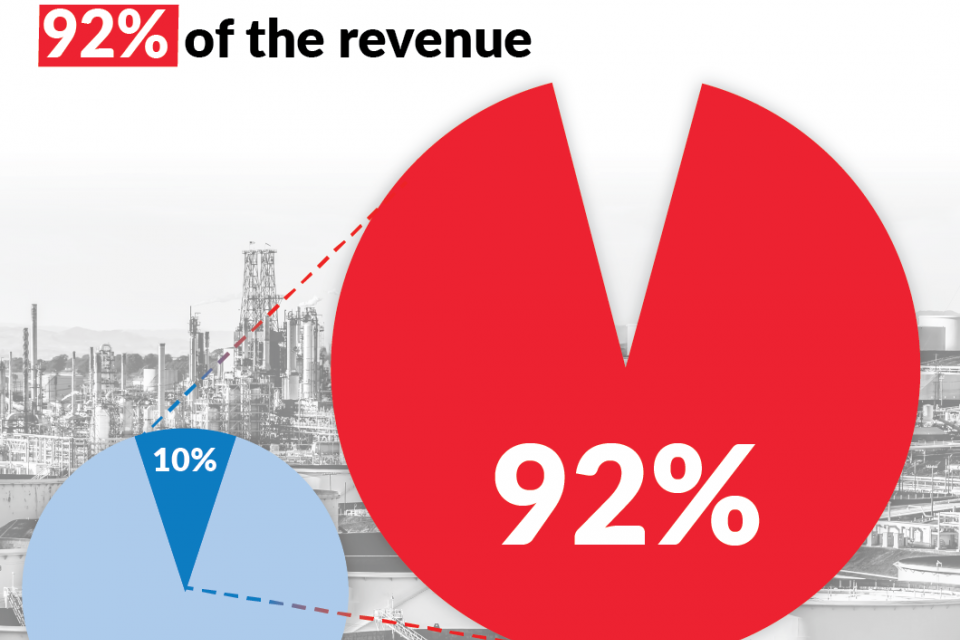

When Prop 15 passes, it will close a loophole that large corporations have used for decades to avoid paying their fair share of property taxes. The richest 10% of corporate properties will provide 92% of the new revenue.

Schools & Communities First placed on ballot as Prop 15

Yes on Proposition 15 this November!

On July 1, California Secretary of State Alex Padilla announced the 12 measures that have qualified for the November election, along with their ballot numbers. Schools and Communities First, the CFT’s top statewide priority in November, will appear as Proposition 15.

CFT says “Tax Billionaires”

We can’t cut our way to the economic recovery our students deserve!

As we navigate the global COVID-19 pandemic, Californians are experiencing crises that reach far beyond the immediate public and personal health emergencies. The poorest Californians, disproportionately people of color in the service, hospitality, and healthcare sectors, have either lost their jobs, resulting in a spike to unemployment unlike anything we have seen in our lifetimes, or are risking their health performing essential frontline services.

How to avoid catastrophic cuts to education and vital social services

OPINION: Tax the super rich

By Jim Miller, AFT Guild, Local 1931

The COVID-19 crisis and subsequent economic collapse along with the national uprising against police brutality and systemic racism have cast a glaring light on the nature of American inequality on the healthcare, criminal justice, and economic fronts. It has never been clearer that as most Americans struggle, the elite thrive.

Members collect 20,000 signatures in support of Schools & Communities First

Hitting statewide goal helped land measure on November 3 ballot

Update: On June 4, Schools and Communities First officially qualified for the November 3 General Election ballot.

Last fall, when CFT began circulating petitions to qualify the Schools and Communities First initiative, seems like a world away. Yet on April 1, the early days of the coronavirus outbreak, the coalition submitted 1.7 million signatures, nearly twice the number needed to put the measure on the November ballot and the most ever gathered in California history.