Each November, the Legislative Analyst’s Office (LAO) is tasked with providing the state Legislature with forecasting of the state’s revenue and budget constraints. Those numbers have just been released to provide a starting point for what to expect in budget negotiations for the California 2021-22 state budget.

Due to the COVID-19 pandemic that shook our state’s economy, the 2020-21 state budget included austere measures to account for the March stock market crash, the millions of workers forced onto unemployment rolls, and unprecedented uncertainty. These actions included large education funding deferrals and cuts to the state employee workforce.

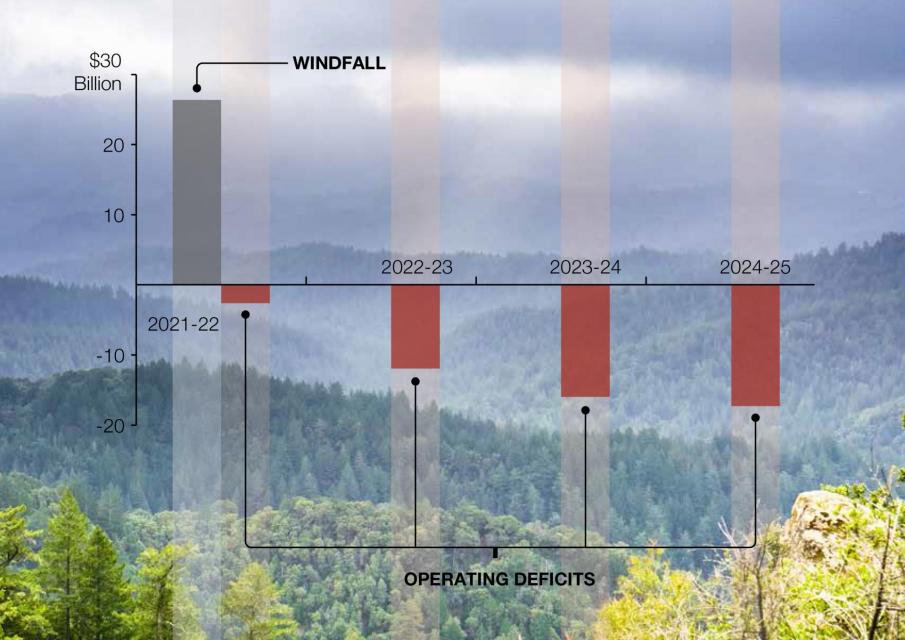

Now five months later, the LAO forecast shows a one-time surplus in the 2021-22 budget, currently estimated at $26 billion. This revenue is mostly due to higher than expected tax payments from wealthy Californians who benefitted from the stock market’s historic rebound.

The LAO estimates this will have a particularly positive fiscal impact on schools and community colleges, with the Proposition 98 minimum guarantee for the current year now projected at 18.5 percent higher than it was in June, when the 2020-21 budget was signed.

If these forecasts hold, the surplus would mean the following for public education:

- The Prop. 98 minimum guarantee is increased by $1.6 billion in 2019-20 and $13.1 billion in 2020-21. The 2021-22 guarantee would be another $595 million more. This is compared to the budget passed in June of 2020.

- The state would be required to make a supplemental payment of $2.3 billion to schools in 2021-22.

- The statutory COLA would be 1.14 percent next year, and increase modestly in the next few out years

With the LAO forecast, the Legislature will have $13.7 billion in one-time funds and $4.2 billion in ongoing funds available for allocation to schools in the upcoming budget cycle. The California Department of Finance has already received $11.3 billion more dollars in state revenue since June than what was anticipated. The Analyst suggests these funds would be able to pay down our planned deferrals in the amount of $12.5 billion, assist in additional support for distance learning, and even be used for more one-time payments to the pension systems.

This forecasting presents light at the end of the tunnel for the upcoming fiscal year; however, we take a cautiously optimistic approach, since the outlook also anticipates operational deficits in future years unless the budget includes new revenue or substantial budget cuts.

As working people know, a stock market recovery does not equate to the overall economy recovering as many workers continue to be unemployed and are losing work and income due to the pandemic. The CFT will continue to advocate for safe and healthy public education, holding our education system harmless from COVID-19 fiscal impacts, and job security for all school employees as we seek out additional funding for our schools to rise above the current and long-standing deficits in public education funding.

— By Tristan Brown, CFT Legislative Representative, and Aimee Shreck, CFT Research Director