Classified Employee Summer Assistance Program

Toolkit for staff in schools and (NEW!) community colleges

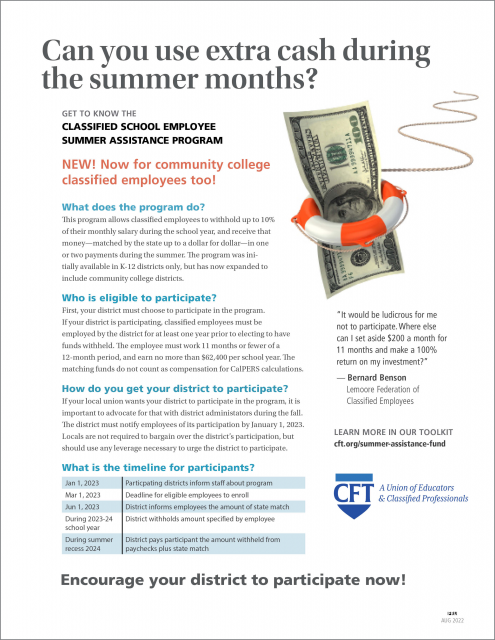

The Classified School Employee Summer Assistance program allows classified employees in K-12 and community college districts to withhold up to 10% of their monthly salary during the academic year, and receive that money — matched by the state up to a dollar for dollar — in one or two payments during the summer.

Please note: In June 2022, the California Legislature expanded the program to include community college districts. On October 27, the Chancellor’s Office released its first memo about program operation for the community colleges. (We expect further updates.)

Who is eligible to participate?

First, your district must choose to participate in the program. If your district is participating, classified employees must be employed by the district for at least one year prior to electing to have funds withheld. The employee must work 11 months or fewer out of a 12-month period, and earn no more than $62,400 per school year.

How do you get your district to participate?

If your local union wants your district to participate in the program, it is important to advocate for that with district administrators during the fall. Local unions are not required to bargain over the district’s participation, but should use any leverage necessary to urge the district to participate. The district must notify employees of its participation in the program by January 1, 2023.

PROGRAM TIMELINE

| Date | Action |

|---|---|

| Fall 2022 | Local unions encourage their districts to participate in the program |

| January 1, 2023 | Participating districts to inform classified staff about program opportunity |

| March 1, 2023 | Deadline for eligible classified employees to enroll in program |

| April 1, 2023 | District informs state it will participate and how many employees have enrolled |

| May 1, 2023 | State informs districts how much the match will be |

| June 1, 2023 | District informs employees how much the state match will be |

| During school year 2023-24 | District withholds the amount specified by the employee |

| By July 31, 2024 | District requests payment from the state agency |

| FOR K-12 During summer recess 2024 |

District pays participants the amount withheld from their checks plus the state match in one or two payments in accordance with the payment plan selected by the employee |

RESOURCES

UNION RESOURCES

- FLYER – Can you use extra cash during the summer months?

Flyer with program overview for K-12 and community college local unions - FAQ for K-12 – Classified School Employee Assistance Program

Download our FAQ for K-12 local unions. - Read our story in the CFT Newsroom

Learn how classified employees in AFT local unions are benefiting from the Summer Assistance Program. - For more assistance

Complete this quick form if your local union is interested in this program and wants more information. We will connect you to your CFT field representative for additional assistance. If you know who it is, you may also contact your field rep directly.

EDUCATION SYSTEM RESOURCES

NEW! For community college districts and unions

- Chancellor’s Office guidance memo – October 27, 2022

For K-12 districts and unions

- California Department of Education has the definitive program information for K-12 districts.

- California Education Code Section 45500 established the Classified School Employee Summer Assistance Program.

HELPFUL FAQ FOR K-12

You may also download this FAQ under Resources.

Who is eligible to enroll in the Summer Assistance Program?

Classified employees who are employed with the school district for 11 months or fewer, who earn less than $62,400 per year in their district job, and who do not work the summer session are eligible to participate.

You must also have been working with your district for at least one year to participate in the program. Please note that charter schools cannot participate in the program. This program requires the district to opt-in. Your district must notify every classified employee regarding their intent to participate in the program by January 1 of each year. It is up to your local union to push the district to participate in the program.

What are the costs to participate in the program?

There are no costs to an employee. Each employee will decide on their own whether to participate and how much of their monthly pay to save (up to 10%). The district must bear the costs to administratively facilitate the notice to employees and notice to the California Department of Education, managing a separate bank account for these savings, and sending the checks to each employee that participates during the summer.

Districts already facilitate withholdings from paychecks for various reasons, send payroll checks during the summer, and conduct standard banking practices regularly. The added costs to implement this program should be absorbable by the district; however, it will require classified local unions to push their districts to participate.

When can we start enrolling in the program?

“It would be ludicrous for me not to participate. Where else can I set aside $200 a month for 11 months and make a 100 percent return on my investment?”

— Bernard Benson, Bus Driver

First, your district must choose to participate in the program. If your local union wants your district to participate in the program, it is important to advocate for that with district administrators during the fall. Local unions are not required to bargain over the district’s participation, but should use any leverage necessary to urge the district to participate. The district must notify employees of its participation in the program by January 1 of each year.

Every eligible classified employee who wishes to participate in the Summer Assistance Fund must complete and return the enrollment form to their district by March 1 of each year. (See the Program Timeline.)

How much money can I withhold every month?

You can have up to 10% of your monthly paycheck withheld during the school year.

How will we receive our funds during the summer recess?

Employees can opt to receive money in one lump sum at the beginning of summer recess or have it distributed in two payments over the recess.

Is the Summer Bridge Fund going to lead to a withholding of part of my paycheck?

The enactment of the program will not lead to a mandatory withholding on your paycheck in the same way that taxes, like Social Security and Medicare, are currently withheld. You will elect, on the California Department of Education form, the percentage of funds you would like withheld. You can contribute up to 10% of your monthly paycheck to the Summer Fund. Think of the Summer Fund as an employer-matched 401(k) retirement account to which you voluntarily contribute.

Am I eligible to contribute to the fund if I work for the district during the summer?

If you work for the school district during the summer session, you will only be able to access the money you have banked. You will not receive matching contributions from the state. Because this program was created as a safety net to help school workers who are unemployed during the summer break, if you accept a summer session assignment with the school district you will not be eligible for the program.

If you work during the summer break at a job outside of the district, you are eligible to enroll in the program and receive matching contributions.

Why am I not eligible for the program if I work summer school?

The Summer Bridge Fund was created to address the problem of unemployment that many classified employees face during the summer recess. It is a safety net to help classified employees make it through the summer months when there is no work available. It is not meant to replace summer session work. While the decision to work during the summer session is up to each member, keep in mind that if you accept a summer assignment with the school district, you will earn more than if you contribute to the Summer Bridge Fund.

It is also important to note that if you have a job outside of the district during the summer, this does not affect your eligibility for the program. Additionally, if you work for a limited time for the district during the months of June, July, and August as part of your regular school-year assignment (not summer session) you are still eligible to participate in the program.

Can I choose to withdraw from the program after I sign up?

You may withdraw from the program due to economic or personal hardship. You will need to request that the district stop withholding contributions from your check and pay you any funds that have been set aside for your summer fund. Keep in mind, however, that if you withdraw from the program, you will not receive any matching funds from the state.

How does a matching fund work?

Your contributions to the fund will be matched by the state. Participating employees will be notified by June 1 of each year as to how much they will receive from the state.

How much funding is available for this program?

Gov. Jerry Brown budgeted $50 million for the 2019-20 summer break when he initially approved the program. Gov. Gavin Newsom added $36 million to this amount. In June 2020, the Legislature appropriated $60 million in one-time funds, which will be available through June 30, 2024.

In June 2022, the Legislature appropriated $35 million in one-time funds plus $90 million ongoing, and established a similar program for community colleges (still to be implemented) with $10 million ongoing funds. The Chancellor’s Office will be putting out initial guidance in February 2023.

If more employees participate than the funding can cover, the amount participating employees receive will be pro-rated. If and when the fund is exhausted, we can ask the Legislature for additional funding.

What information will my district share with the California Department of Education?

The district or county office of education must share with the CDE their intention to participate in the Summer Fund, the number of classified employees participating, and an estimation of the total amount of funds to be withheld from those employees’ paychecks.

Will my summer funds contribute to my retirement savings?

No. Funds from the state match for classified employees will not be considered compensation for retirement benefits in the California Public Employees’ Retirement System.

What happened to our fight for summer unemployment insurance benefits?

During the past decade, several bills have been introduced in Sacramento to change the current law so that classified employees could be eligible to receive unemployment insurance benefits during the summer break. Unfortunately, those bills have not become law. (Learn about the CFT’s earlier efforts to win unemployment benefits for classified employees.)

During the process, however, we educated legislators about the problem. Many of them agreed that dedicated school workers should not have to suffer during the summer. Their main concern has been that the state cannot afford the cost of paying benefits out of the current unemployment insurance fund. That is why we’ve come up with a different solution through the Summer Assistance Fund.

Don’t we already pay into the state’s unemployment benefits fund? Can’t we just access the benefits we’re already paying into?

A common misconception is that classified employees are paying into the state’s unemployment insurance fund, but are denied access to unemployment benefits. Actually, classified workers do not pay into the state’s unemployment insurance fund. No money is deducted from their paychecks for this purpose. The reason they don’t pay into the fund is because — unlike other employees that do pay into the fund — classified workers are currently excluded from accessing unemployment benefits.

We have fought to change that through legislation and influencing the state budget. The Summer Bridge Fund is part of the solution to addressing the summer unemployment issue.

Why are classified workers excluded from access?

School workers are not considered by the state and school district to be unemployed during the summer recess. This is the reason why school workers, under normal circumstances, are denied when they try to apply for unemployment benefits.

This does not mean school workers are completely ineligible to receive unemployment insurance benefits. There are some ways a school worker could be eligible:

- Permanent layoffs: School districts pay into the state’s School Employees Fund (SEF). This is a voluntary fund managed by the EDD that is used to cover unemployment insurance benefits to school workers in cases of permanent layoffs. Note that a school district’s participation in the SEF has no effect on the pay of school workers.

- Cancelled summer assignment: If a school worker was offered a summer school assignment and that assignment was subsequently cancelled.

- No reasonable assurance: If a school worker does not have reasonable assurance to return to the same or similar position at the end of the recess or did not receive proper notification of reasonable assurance.

PROGRAM CHANGES IN 2021 DUE TO COVID

The 2021 education budget trailer bill authorized a K-12 district classified employee to be eligible to participate in the program if the employee is employed by the Local Education Agency in the employee’s regular assignment for 11 months or fewer out of a 12-month period. For purposes of determining an employee’s total months employed by the LEA, the bill requires the LEA to exclude any hours worked by the classified employee as a result of an extension of the academic year, for specified school years, directly related to the pandemic.

For the 2020–21, 2021–22, and 2022–23 school years, the employing LEA shall exclude any hours worked by the classified employee as a result of an extension of the academic school year directly related to the pandemic, if the hours are in addition to the employee’s regular assignment and would prevent the employee from being eligible for this program.