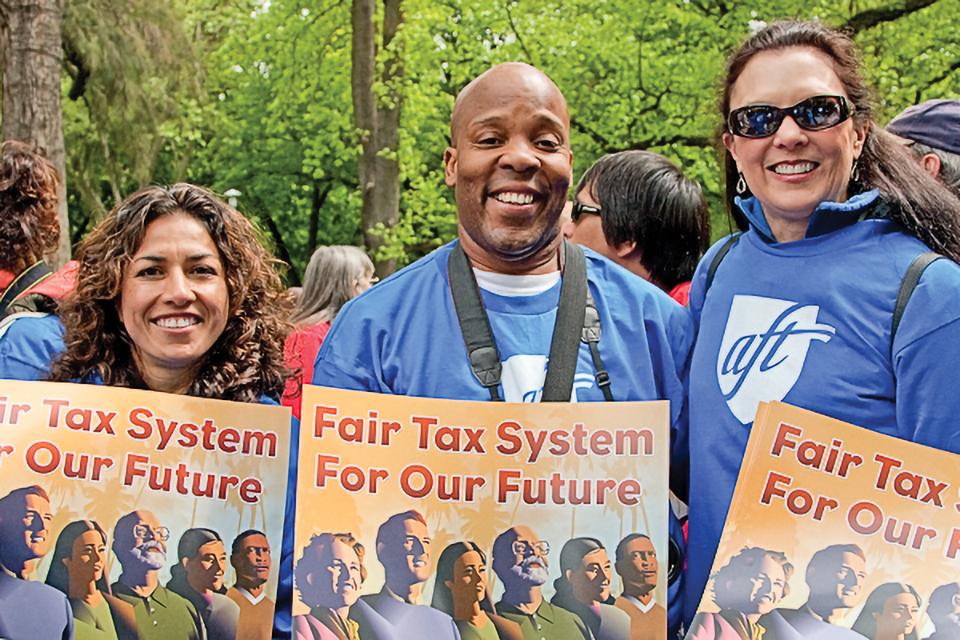

Tax Fairness Campaign

CFT-sponsored wealth tax introduced in California Assembly

Part of coordinated effort with seven other states

In a concerted effort with seven other states, yesterday CFT President Jeff Freitas and Assemblymember Alex Lee (D-San José) reintroduced a tax on extreme wealth in California as AB 259 and an accompanying proposed constitutional amendment, ACA 3.

CFT sponsors California tax on extreme wealth

Why tax extreme wealth?

Since the beginning of the pandemic last March, while our families and our communities have suffered gut-wrenching pain and loss, billionaires in our state alone have increased their wealth by over half a trillion dollars.

And their numbers and their extreme wealth just keep on growing. In March 2020, just as COVID began, there were 154 billionaires in California – with a total wealth of $688.3 billion. In January 2021, there were 169 billionaires in California – with a total wealth of more than $1.2 trillion.

CFT says “Tax Billionaires”

We can’t cut our way to the economic recovery our students deserve!

As we navigate the global COVID-19 pandemic, Californians are experiencing crises that reach far beyond the immediate public and personal health emergencies. The poorest Californians, disproportionately people of color in the service, hospitality, and healthcare sectors, have either lost their jobs, resulting in a spike to unemployment unlike anything we have seen in our lifetimes, or are risking their health performing essential frontline services.